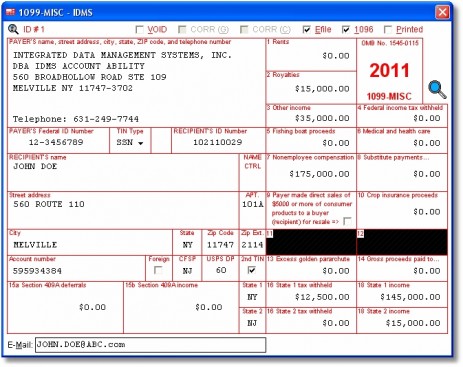

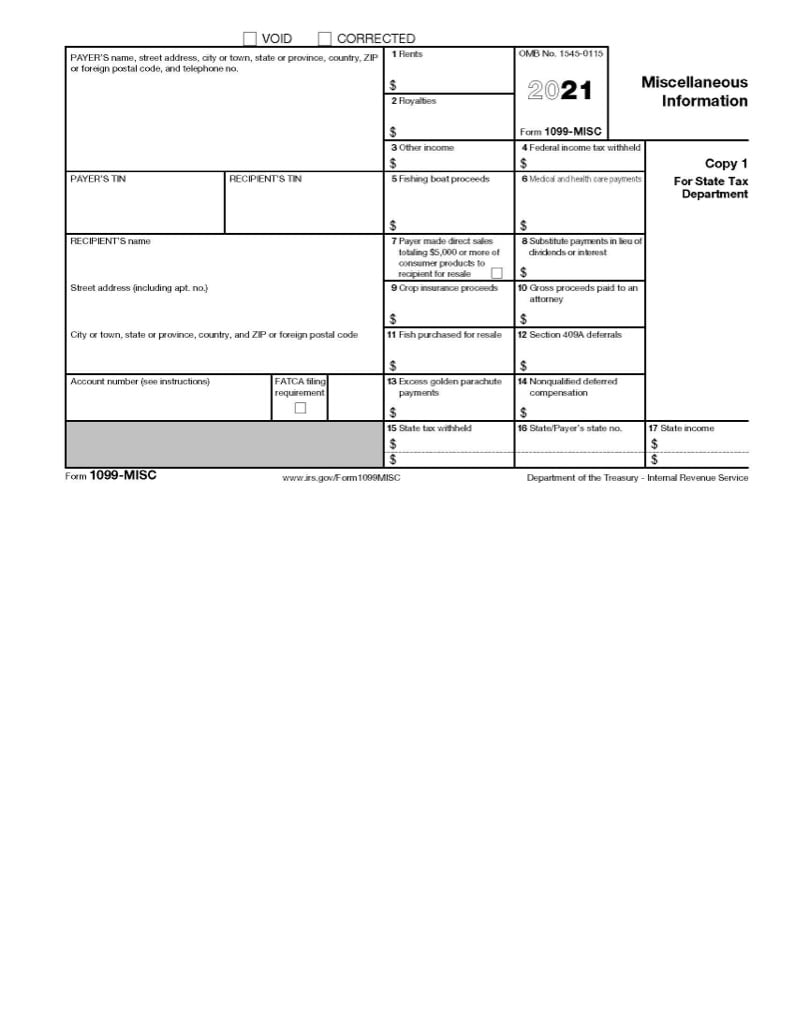

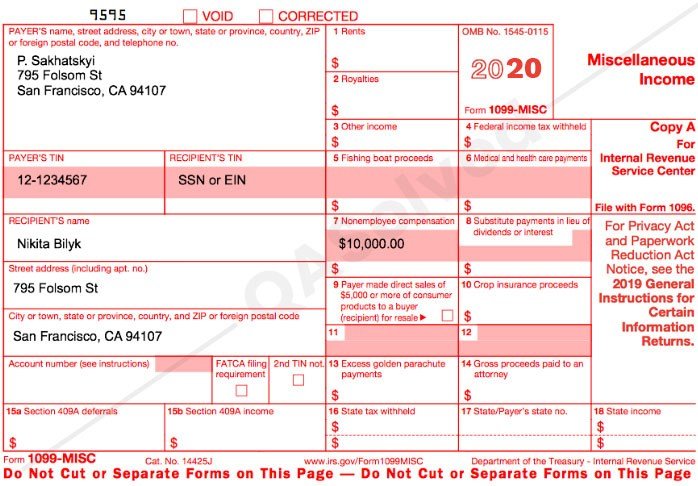

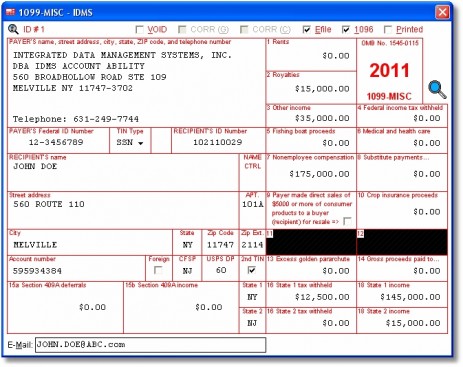

1317 · Form 1099MISC, Miscellaneous Income, can also be significant Who Needs to File Form 1099?Basic 1099MISC Filing Instructions To complete a 1099MISC, you'll need to supply the following data Business information – Your Federal Employer ID Number (EIN), your business name and your business address Recipient's ID Number – The recipient's Social Security number or Federal Employer ID Number (EIN) Payment Amounts – Enter amounts paid in the appropriate box21 · A 1099Misc is an IRS form required to be completed and sent to nonemployees no later than January 31, Similar to a W2, a 1099Misc is a tax form showing how much was paid to a vendor or subcontractor throughout the year

1099 Misc Software That Can Save Businesses Thousands In Irs Penalties This Year Idms Inc Prlog

Completed 1099 misc form

Completed 1099 misc form-You can face fines for not sending out your 1099 Forms by the deadline For 1099 filed up to 30 days late, you can face a $50 per 1099 fine For those filed more than 30 days late, it's $100 per 1099At this time, Form 1099Miscellaneous and 1099NEC Income statements are not available on chkcom To request a copy of your 1099 or if you have further questions, please contact Owner Relations and include your complete account number, the last four digits of your Tax Identification Number or Social Security Number along with all details related to your inquiry

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

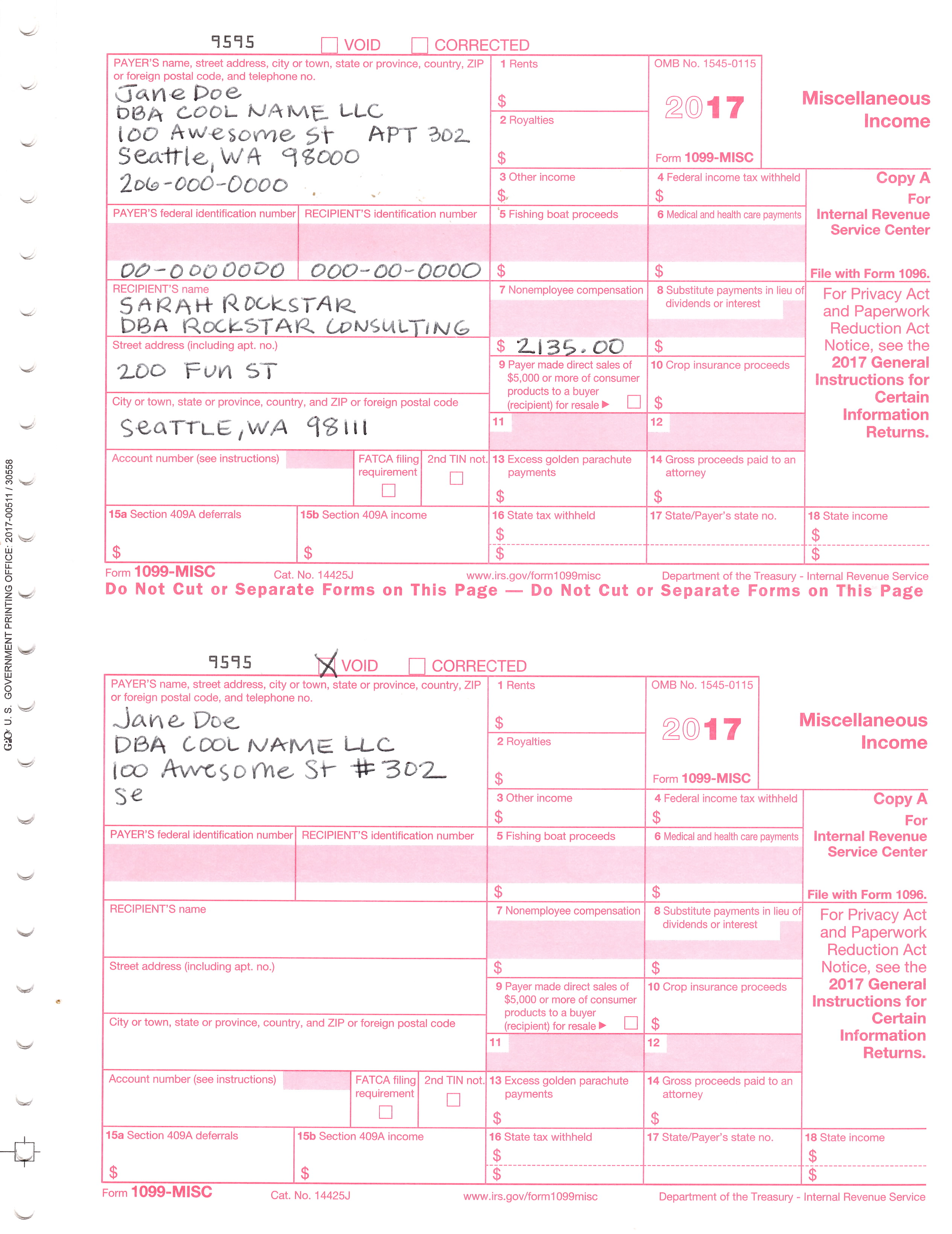

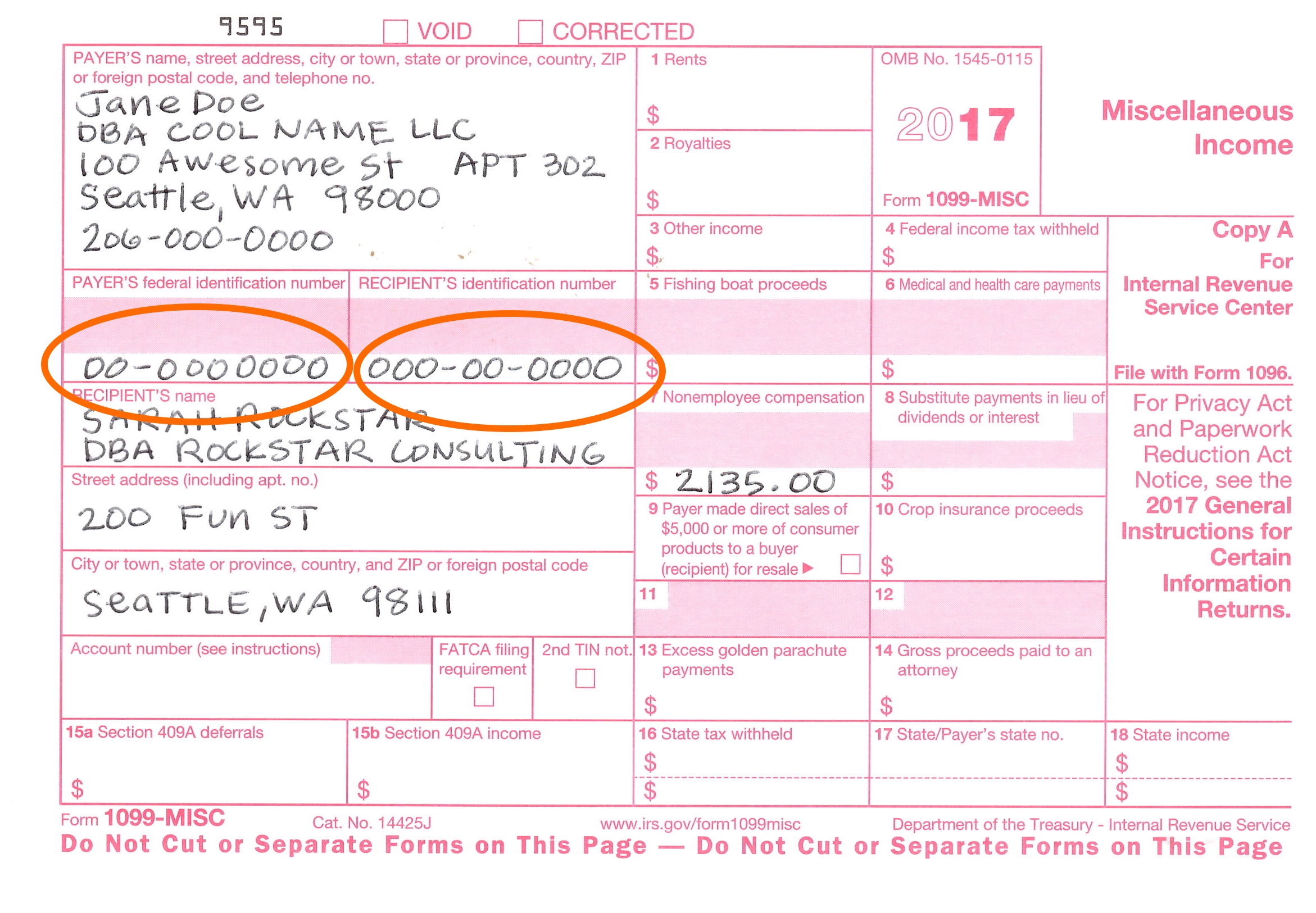

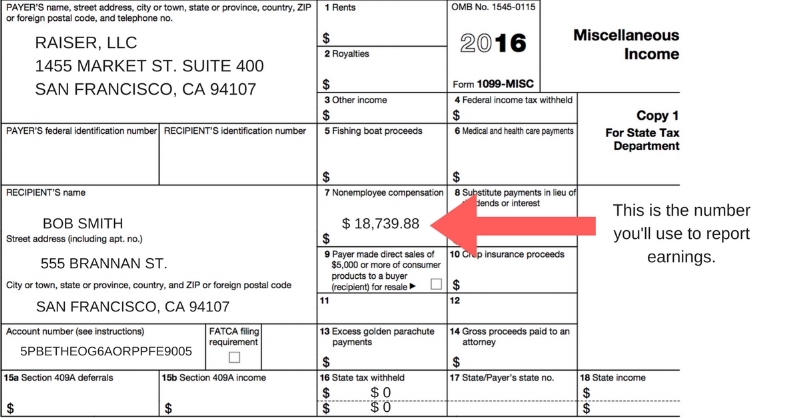

Completed 1099 Misc Form December 25, 19 by Role Advertisement Advertisement 21 Gallery of Completed 1099 Misc Form 1099 Misc Printable 1099 Form Irs Form 1099 Misc 1099 Misc Form Example Form 1099 Misc With Nec In Box 7 Tax Form 1099 Misc 1099 Misc Tax Form Example How To Get A 1099 Misc Form · Interest income earned by a taxpayer is reported on a Form 1099INT On a typical 1099 form, such as the 1099MISC, the income earned will be noted, but there will not be any deductions for federal or state income taxes, nor will any deferred compensation, Social Security or medical deductions that can be notedSTEP 3 Prepare Your 1099 MISC Forms Start preparing 1099 MISC forms for independent contractors, once you have bought the 1099 forms Fill in your Federal Tax ID number (SSN or EIN) and contractor's information (SSN or EIN) accurately Ensure you enter the same amount of money you paid to the contractor in Box 7 under the title "Nonemployee compensation"

If you need to enter another 1099MISC, select Add Another 1099MISC to enter a new oneThis guide explains how to transpose your 1099B onto your IRS 49 CoinList Was the Only Exchange I Traded On If all of your assets were acquired and stored on CoinList's platform then your 1099B will be complete The 1099B provides you with all of your taxable events and can be directly transposed onto your IRS 49 and filed · Step 2 Complete the 1099MISC form Complete the PAYER's name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone section with your company's information In the PAYER's TIN box, enter your company's TIN In the RECIPIENT's TIN box, enter the contractor's TIN

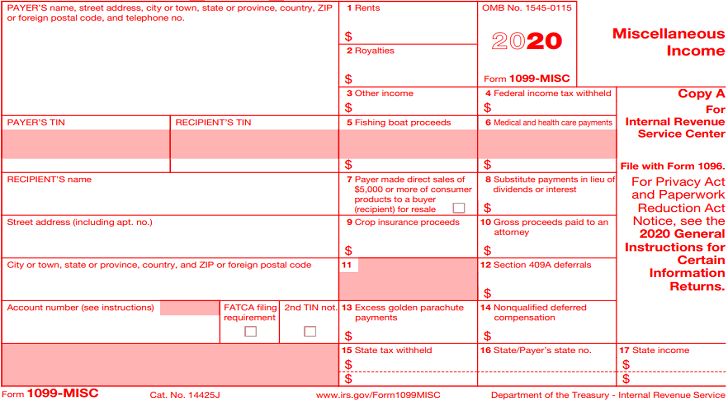

0112 · Learn how to avoid 1099 mistakes and how to correct a 1099 if you make one What you need to know about 1099 forms Forms 1099 are information returns that businesses use to report certain payments There are two types of 1099 forms Form 1099MISC and Form 1099NEC Between 19 – , businesses used Form 1099MISC for all 1099 reporting1099 Sample Forms This appendix includes the following sample forms Appendix H, "1099 Miscellaneous Income (Updated for 1099)" Appendix H, "1099 Nonemployee Compensation" Appendix H, "1099 Dividends and Distributions (Updated for 1099)" Appendix H, "1099 Interest Income" These forms are for informational purposes only · Form 1099MISC Miscellaneous Income (or Miscellaneous Information, as it's called starting in 21) is an Internal Revenue Service (IRS) form

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Form 1099 Misc It S Your Yale

· How To Complete IRS Form 1099MISC?How to Complete the 1099MISC Form Areas "A" through "G," as shown on the form below, must be completed for each recipient You should always obtain the information required for the 1099MISC before any payments are made—especially the payee's Social Security number or employer identification numberHiring a contractor can be a stressful job, but unfortunately your job is not done once you write that final check At the end of the year you may also need

1099 Nec Or 1099 Misc What Has Changed And Why It Matters Pro News Report

17 Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

Filing 1099 Form by Mail 1099MISC Copy A –If you choose to file physical copies of your 1099s, you'll need to fill out a physical copy of Form 1099MISC that you'll get from the nearest IRS office–you can't just print one off of the IRS website After you complete the form, you'll mail it back to the IRS by February 28Sample Completed 1099 Misc Form adahveum December 9, 19 Templates No Comments 21 posts related to Sample Completed 1099 Misc Form Sample 1099 Form Completed 1099 Misc Template 17 Unique Sample 1099 Form Luxury 24 Fresh Image 1099 Form Template Word Sample Cms 1500 Form Completed0219 · Sample Completed 1099 Misc Form February , 19 by Mathilde Émond 24 posts related to Sample Completed 1099 Misc Form Sample 1099 Form Completed 1099 Misc Template 17 Unique Sample 1099 Form Luxury 24 Fresh Image 1099 Form Template Word

1099 Misc Form Fillable Printable Download Free Instructions

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

· What are the fines for missing the Form 1099 deadline?EFile 1099 Misc Supports Following Forms e file 1099 misc is made to fulfil every user 1099 tax compliance filing needs We take care of your complete 1099 reporting requirements online, You can prepare the form online, efile with IRS and Mailing Copy B Recipients e file 1099 misc Supports Following FormsRequires you to file Form 1099MISC on or before January 31, , if you are reporting NEC payments in box 7, using either paper or electronic filing procedures For all other reported payments, file Form 1099MISC by February 28, , if you file on paper, or March 31, , if you file electronically

Esmart Payroll Tax Software Filing Efile Form 1099 Misc 1099c W2 W2c 940 941 De9c E File Corrections

1099 Misc Instructions And How To File Square

Form 1099 MISC Line by Line Instructions Updated on January , 21 1030am by TaxBandits The Internal Revenue Service (IRS) expects every business owner to file Form 1099MISC to report miscellaneous payments made to the independent contractors for their work For tax year , payers have to report non employee compensations on a new separate form, the 1099If your business paid $600 or more to an independent contractor or another business, you'd most likely need to complete Form 1099NECMiscellaneous Income 1099MISC 2up Federal Copy A form Order the quantity equal to the number of recipients for which you file Plus FREE SHIPPING to the continental 48 states IMPORTANT You may need to use the new 1099NEC form with or instead of the 1099MISC!

1099 Misc Tax Basics

How To Fill Out Irs Form 1099 Misc Easy Instructions Tipalti

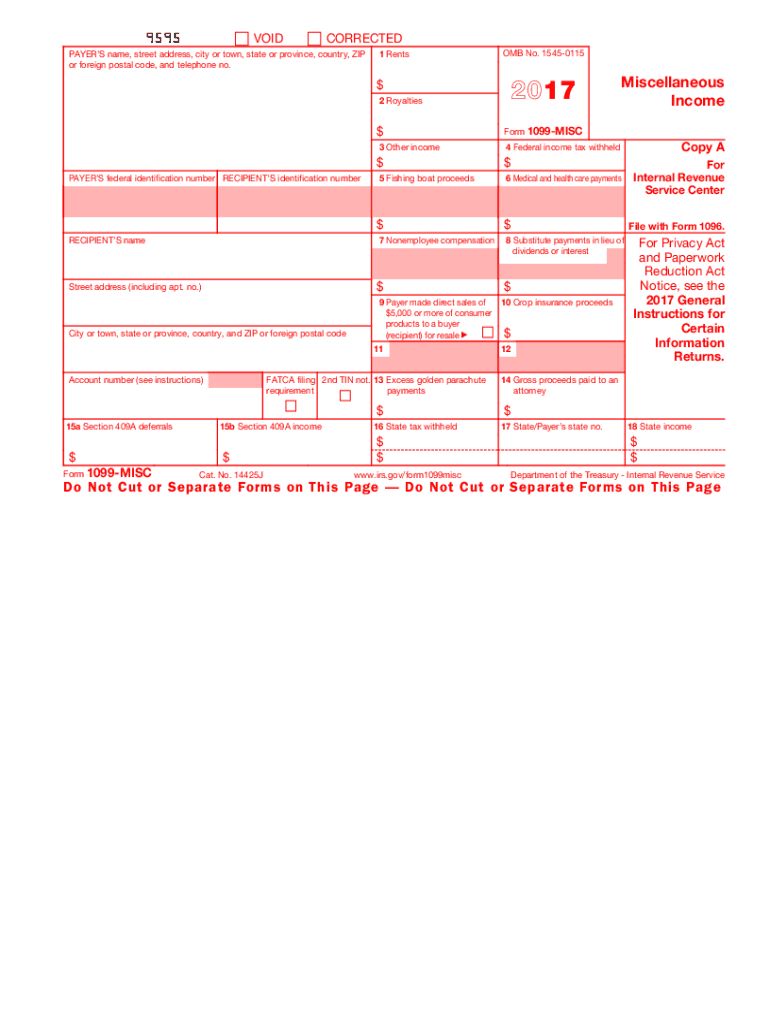

1099MISC Cat No J Miscellaneous Income Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the General Instructions for Certain Information Returns 9595 VOID CORRECTEDThis section provides a sample of the 1099MISC form, which you use to report miscellaneous income 1031 1099MISC Form Sample These are examples of 1099MISC forms for 193101 · To enter the income from a Box 7, 1099Misc You can enter a 1099MISC on the 1099MISC Summary screen Open or continue your return Search for 1099misc Select the option to go to the 1099MISC section Select Yes to Did you get a 1099MISC?

Form 1099 Nec For Nonemployee Compensation H R Block

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

· The deadline for filing your 1099MISC form is January 31st Make sure to send both a copy to the contractor and the IRS before this date Lastly, as a business you will also need to submit 1096 form to the IRS This form is a summary of all the 1099 forms you have submitted for each independent contractorCompleting Form 1099MISC and Form 1096 This lesson will discuss the various copies of Form 1099MISC and to whom (and under what circumstance) each copy must be sent Lesson Six also covers the various boxdependent due dates for Forms 1099MISC, and provides stepbystep instruction for the proper completion of Form 1099MISC and Form 10960311 · Form 1099MISC, Miscellaneous Income, is an information return businesses use to report payments and miscellaneous income File Form 1099MISC for each person you have given the following types of payments in the course of your business during the tax year At least $10 in royalties or broker payments in lieu of dividends or taxexempt interest

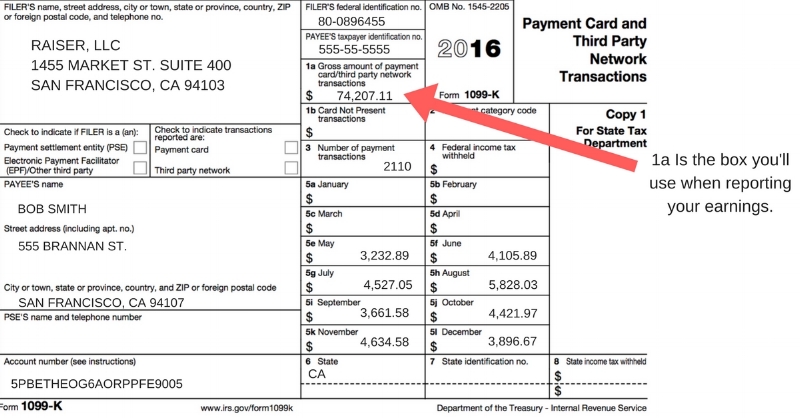

1099 K Vs 1099 Misc What S The Difference Zipbooks

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

More than 70% of filers in 19 reported information in Box 7 of form 1099MISC · How to File a 1099 Form it is your client's responsibility to send you a completed copy of the Form 1099MISC by January 31 Let's enter the "dollars" data for this payee's 1099MISC At the end, you can see the completed 1099Misc formSample Completed 1099 MISC Form – In general, any business which has paid out a minimum of $600 to a individual or any unincorporated organization which has received a minimum of two income amounts from that person or organization should problem a 1099 Form to each individual or company that has obtained at least one of those income quantities This form is utilized by the

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

Irs Takes Non Employee Compensation Out Of 1099 Misc New Form 1099 Nec Cpa Practice Advisor

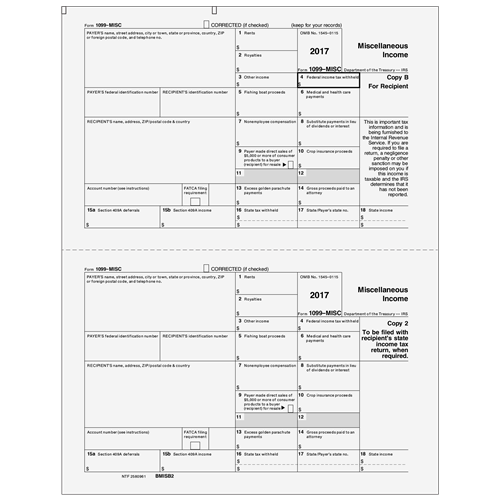

Payer must complete 5 copies when filing Form 1099MISC Copy A of Form 1099MISC must be filed with the IRS Copy 1 of Form 1099MISC must be filed with the State tax department Copy B must be furnished to the recipient Copy 2 must be filedCopies of Form 1099MISC Copy A is sent to the IRS This should be printed on a laserscannable form Copy 1 is filed with the State Tax Department Copy B is for your recipient Copy 2 is issued to the recipient for filing their state tax returns Copy C is for your business records What Information Will I · After you complete Form 1099NEC, you should send a copy to recipients no later than February 1, 21, while filing a copy with the IRS, electronically or on paper, by the same date Unlike an automatic extension for the provision of 1099MISC copies to recipients, as further discussed below, no automatic extension for Form 1099NEC exists

Don T Wait Until Tax Time To Get Ready To Send Your 1099 Tax Forms Blog For Accounting Quickbooks Tips Peak Advisers Denver

1099 Misc Form What Is It And Do You Need To File It

Form 1099MISC 12 Miscellaneous Income Copy 1 For State Tax Department Department of the Treasury Internal Revenue Service OMB No VOID CORRECTED PAYER'S name, street address, city, state, ZIP code, and telephone no1099 Misc Form Fill out, securely sign, print or email your 19 Form 1099MISC IRSgov instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!Inst 1099LTC Instructions for Form 1099LTC, Long Term Care and Accelerated Death Benefits 19 10/27/19 Form 1099MISC Miscellaneous Income (Info Copy Only) 11// Form 1099MISC Miscellaneous Income (Info Copy Only) 21 Inst 1099MISC

1099 Misc Instructions Irs Form 1099 Misc 1099 Misc Contractor

Order 1099 Nec Misc Forms Envelopes To Print File

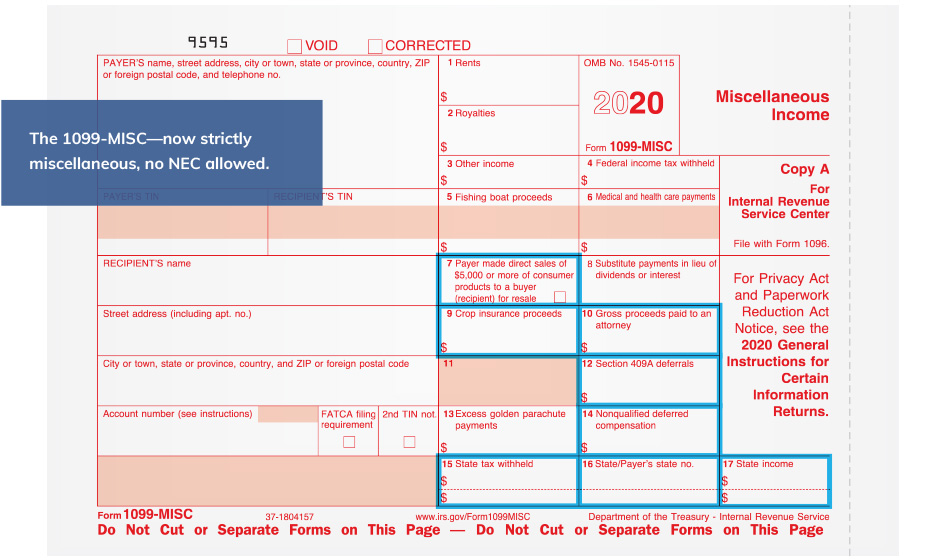

On the completion of the 1099 MISC, a copy also needs to be sent to the recipient This is Copy B and should be sent across to the "nonemployee" before January 31 st Contrary to Copy A, Copy B can be downloaded and printed from the IRS' official websiteDownload & Create Your 1099MISC Tax Form here https//formswiftcom/1099miscA 1099MISC Tax Form is a form used for independent contractors and freelancer · Form 1099MISC The 1099MISC form used to include payments made to nonemployees, but in these payments were segregated on their own Form 1099NEC For tax year and going forward, Form 1099MISC covers only miscellaneous payments

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Form 1099 Nec Requirements Deadlines And Penalties Efile360

The 1099NEC is used to pay freelancers and independent contractors This is a recent change as a 1099MISC was previously used to record payments to freelancers and independent contractors Completing and filing this tax form is easy Simply fill in the appropriate boxes according to the definition of the boxes you learned about in this guide11 · Form 1099MISC is still in use for the tax year and beyond, but it no longer includes nonemployee compensation It reports payments such as rents, prizes and awards, medical and health care payments, nonqualified deferred compensation, consumer goods for resale, and royalties —basically miscellaneous payments to anyone who isn't an independent · In the United States, Form 1099MISC is a variant of Form 1099 used to report miscellaneous income One notable use of Form 1099MISC was to report amounts paid by a business (including nonprofits 1 1 ) to a noncorporate US resident independent contractor for services (in IRS terminology, such payments are nonemployee compensation ), but starting tax

How To Fill Out 1099 Misc Irs Red Forms

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

1612 · If you're a contractor, it's your client's responsibility to send you a completed copy of the Form 1099NEC by January 31, 21 If you haven't received Copy B of a 1099 from your client by the deadline, and you believe you should have, make sure you request it You will need it to file your income taxes in AprilExample Of A Completed 1099 MISC Form – Generally, any organization that has paid out at least $600 to a person or any unincorporated organization that has received at least two payment amounts from that person or organization must problem a 1099 Form to every individual or business who has received at least one of these payment amounts This form is used by the IRS · Nicole Madison Date January 30, 21 12 1099misc form A 1099MISC is a type of tax form It is used to report miscellaneous income, such as income earned as a nonemployee, as well as fees, commissions, rents, or royalties paid during the last tax year

1099 Misc Form Fillable Printable Download Free Instructions

Form 1099 Misc Katopia Design

1807 · Providing 1099MISC to your contractors is equally essential as providing W2s to your employees Most businesses have systems in place or use thirdparty services for payroll processing, and they take care of the yearend W2 filing

Reporting Payments On 1099 Misc Form The Roper Group Inc

Federal 1099 Filing Requirements 1099 Misc 1099 K

How To File 1099 Misc For Independent Contractor

Irs Form 1099 Misc How To Fill It Right

1099 Misc Software To Create Print E File Irs Form 1099 Misc

1099 Misc Tax Form Pressure Seal W 2taxforms Com

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Form 1099 Misc Launch Consulting

1099 Misc Form Copy C 2 Recipient State Zbp Forms

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Your Ultimate Guide To 1099s

What Are Irs 1099 Forms

Irs 1099 Misc Vs 1099 Nec Inform Decisions

1099 Misc Forms The What When How Buildium

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Video What You Need To Know About Form 1099 Nec Olsen Thielen Certified Public Accountants Consultants

Irs Makes Substantial Changes To 1099 Misc Form Williams Keepers Llc

Form 1099 Misc 2up Miscellaneous Income Recipient Copies B 2 Bmisb5

How To File A 1099 Misc Online 21 Qasolved

1099 Misc Software That Can Save Businesses Thousands In Irs Penalties This Year Idms Inc Prlog

1099 Misc 1099 Express

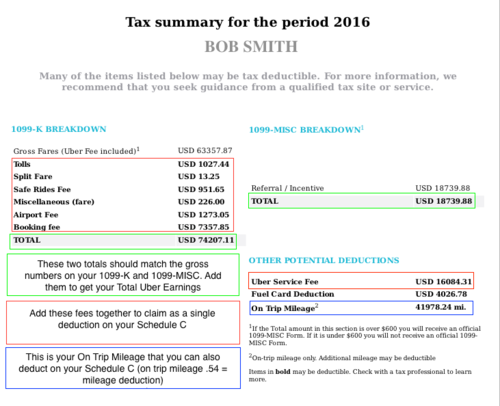

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Irs 1099 Misc 10 Fill And Sign Printable Template Online Us Legal Forms

/how-to-prepare-1099-misc-forms-step-by-step-397973-final-HL-ccf162add47a4d61bb61fca1ea3e3c62.png)

How To Prepare 1099 Nec Forms Step By Step

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

Irs Form 1099 Misc Irs Form 1099 Nec Lancaster Cpa Firm

Change To 1099 Form For Reporting Non Employee Compensation Ds B

1099 Misc Form And Other Tax Forms Online Only At Stubcreator

Sample 1099 Misc Forms Printed Ezw2 Software

1099 Misc Form Copy B Recipient Zbp Forms

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

Need To File 1099 Misc For 18 What You Need To Know S J Gorowitz Accounting Tax Services P C

Horizon Software Firetax

1099 Misc Public Documents 1099 Pro Wiki

1099 Misc Form 19 Print 1099 Form 1099 Online Filing For 19

1099 Form Fileunemployment Org

1099 Misc 14

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

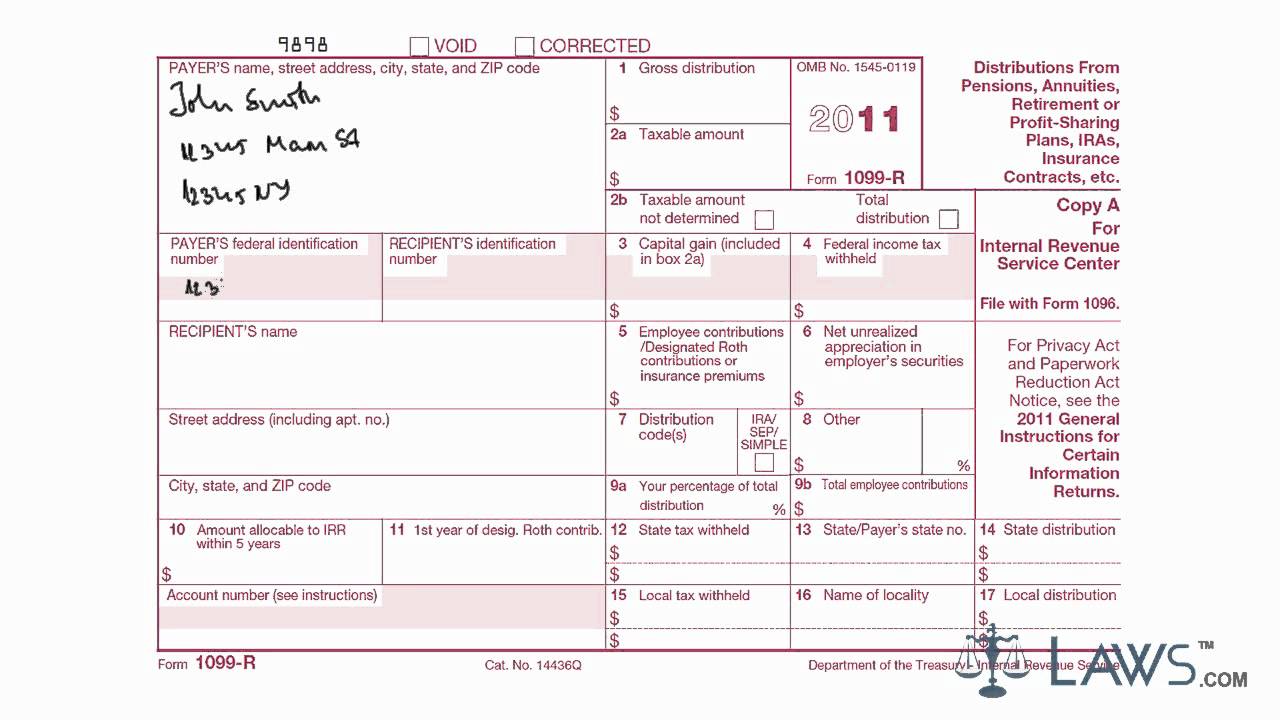

Learn How To Fill The Form 1099 R Miscellaneous Income Youtube

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

How To File 1099 Taxes Online Unugtp

How To Make Sure Your 1099 Misc Forms Are Correct Cpa Practice Advisor

1099 Misc Form Fillable Printable Download Free Instructions

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

How To Fill Out A 1099 Misc Form

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

1099 Misc Carbonless 5 Part W 2taxforms Com

How To Electronically File Irs Form 1099 Misc Youtube

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

What Is Irs Form 1099 Misc Weny News

How To Fill Out Form 1099 Misc Reporting Miscellaneous Income

A Taxbandits Guide To Forms W 2 1099 Nec And 1099 Misc Blog Taxbandits

Irs Introduces New Ish Form To Replace Parts Of Form 1099 Misc Taxgirl

New Irs Rules For 1099 Independent Contractors

:max_bytes(150000):strip_icc()/MiscellaneousIncome-dff90d4dcb754dd1a08e153167070669.png)

Irs Form 1099 Misc What Is It

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

The New 1099 Nec

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

1099 Nec A New Way To Report Non Employee Compensation

Form 1099 Misc It S Your Yale

1099 Misc Tax Form Diy Guide Zipbooks

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

1099 Rules For Business Owners In 21 Mark J Kohler

:max_bytes(150000):strip_icc()/ScreenShot2020-08-20at4.33.51PM-544b6d1adff646f68daaa86ef975a0d8.png)

Form 1099 Misc What Is It

How To Fill Out 1099 Misc Irs Red Forms

1099misc Filing Forms Software E File Zbpforms Com

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Archives W9manager

0 件のコメント:

コメントを投稿